Dear Investor,

Your properties with Southern Sky have continued to perform steadily, and with the city's momentum building, 2026 looks even brighter. Below, I'll highlight key market trends, exciting developments, and rental projections tailored to single-family homes like yours.

Nashville's Market Momentum: Population Boom Meets Supply Tightening

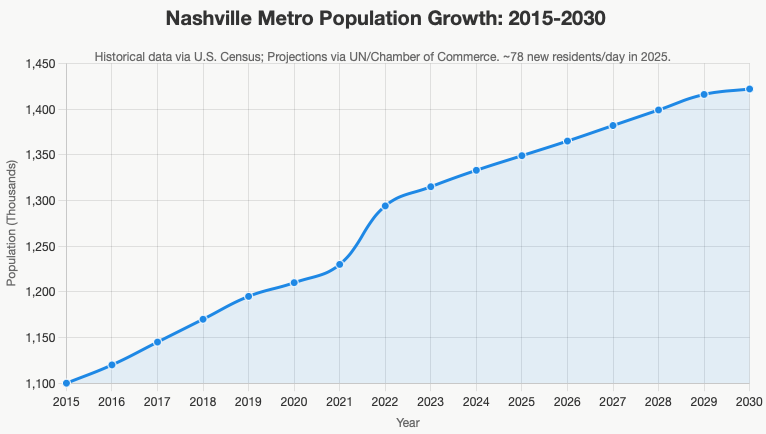

Nashville remains a magnet for growth, with 78 new residents arriving daily in 2025 alone—translating to over 36,000 people added this year, a 1.7% increase. Over the past 25 years, the city's population has surged more than 25%, driving demand for housing and rentals in neighborhoods. “Nashville’s economy continues to buck national trends, with the city’s unemployment rate near an all-time low at 3%, compared to 4.5% for the U.S.” Population Source, Housing, Future Population

While we've seen some oversupply in recent years (easing pressure on rents short-term), the tide is turning. Metro projections show Nashville facing a shortage of at least 20,000 homes over the next decade, as construction lags behind needs. Builder permits are at their lowest levels in years, signaling a tightening supply that should boost demand and values in 2026 and beyond. Homebuilders are adapting by "doing more with less," focusing on efficient projects to meet this gap. This bodes well for your single-family rentals: expect stabilization now, followed by upward pressure on occupancy and rents as families seek stable homes in established areas as estimated by local economists.

Spotlight on Transformative Developments

Nashville's East Bank and Gulch are evolving into world-class destinations, enhancing appeal for renters and driving property appreciation. Here's the latest:

Oracle's East Bank Campus: Tech giant Oracle is advancing its 76-acre headquarters on the East Bank (opposite Germantown), targeting 8,500 jobs by 2031 in a project now exceeding $2 billion. Recent permits reveal plans for a new road bridging over I-24 to connect directly to East Nashville, improving access and tying into the broader Germantown-to-East Bank infrastructure. Renderings show a stunning lakeside walkway, green spaces, and a Nobu Hotel—positioning this as a live-work-play hub that elevates nearby rentals. oracle link, east bank link

Germantown-to-East Bank Bridges & Connectivity: As part of the East Bank's $5B+ transformation (anchored by the new Titans stadium), pedestrian and vehicular bridges are progressing to link Germantown across the Cumberland. Oracle's I-24 overpass is a key piece, reducing commute times and boosting East Bank desirability for families

Cumberland Junkyard Redevelopment: The long-stalled 45-acre scrapyard site on the Cumberland (formerly PSC Metals) is advancing under new ownership, with Park Itahan selling a majority stake while retaining a development position. Plans call for mixed-use residential and commercial space by late 2026, reclaiming waterfront land for community assets like parks and rentals—directly benefiting East Bank property values (updated via recent NBJ filings).

Ritz-Carlton Gulch Tower: Luxury is coming to the Gulch with a 40+ story Ritz-Carlton tower (near the Four Seasons in SoBro for seamless high-end synergy). Features include a rooftop pool, 20,500 sq ft of restaurant space, and 9,540 sq ft of retail, with construction ramping up for a 2027 opening. Partnered with Magellan Development, this will draw affluent renters and tourists, spilling demand into surrounding single-family markets.

These projects aren’t just downtown headlines—they’re fueling 5-7% appreciation in core Nashville while your rentals in Hermitage, Franklin, and the fastest-growing suburb Mount Juliet (currently leading the metro in rent growth at ~4% thanks to lakefront appeal and fast I-40 access) enjoy a reliable 3-5% annual lift as families flock to space, top schools, and new job centers.

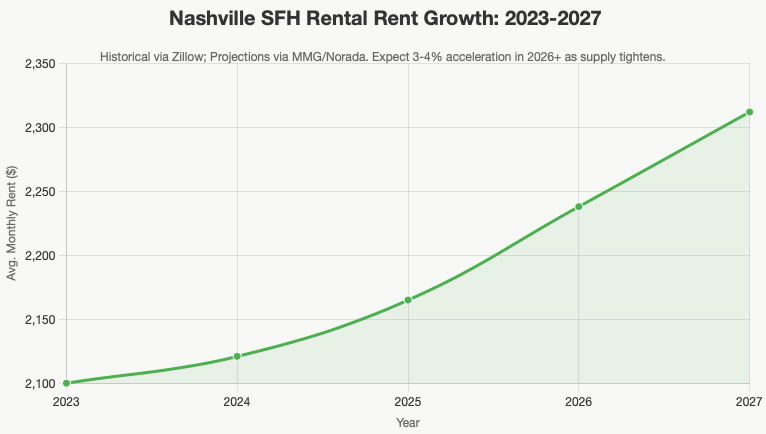

Single-Family Rental Projections: Steady Growth Ahead

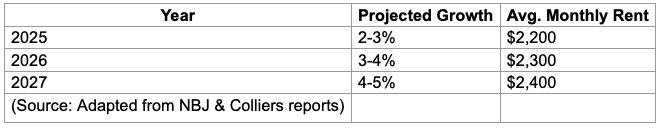

For single-family homes, 2025 has seen moderated rent growth (around 2-3% YOY in the South due to lingering supply), but expect acceleration: 3-4% increases in 2026 as construction slows and demand rises from population influx (regional benchmark; Nashville mirrors this with its housing gap). Occupancy remains high at 95%+, with SFH premiums over apartments (7-10% higher rents for space and yards). Long-term: Aim for 4-5% annual escalations through 2027, outpacing inflation.* rent growth link, population growth link

A Timely Opportunity: Unlocking Equity Through Refinancing

If anyone has had a conversation with me over the past few years they know I have been in the “higher for longer camp” when it comes to interest rates. However, I think we are approaching (finally) a pivot to an actual decrease in rates. With economists forecasting mortgage rates to dip toward lower end of 5% in 2026-2027 (from today's 6.5-7%), refinancing could be a game-changer for your portfolio. Imagine tapping into the equity you've built—often 20-30% gains since purchase—and redeploying it as low-cost capital to acquire another cash-flowing rental. It's not just pulling money out; it's strategically leveraging your assets to compound wealth, all while locking in lower payments for even stronger returns. Let's chat soon about running the numbers for your properties—no obligation, just options.

Jeff Irwin

Southern Sky Realty, LLC

Email Jeff@southskyrealty.com.